louisiana inheritance tax waiver form

Addresses for Mailing Returns. Inheritance tax laws from other states could.

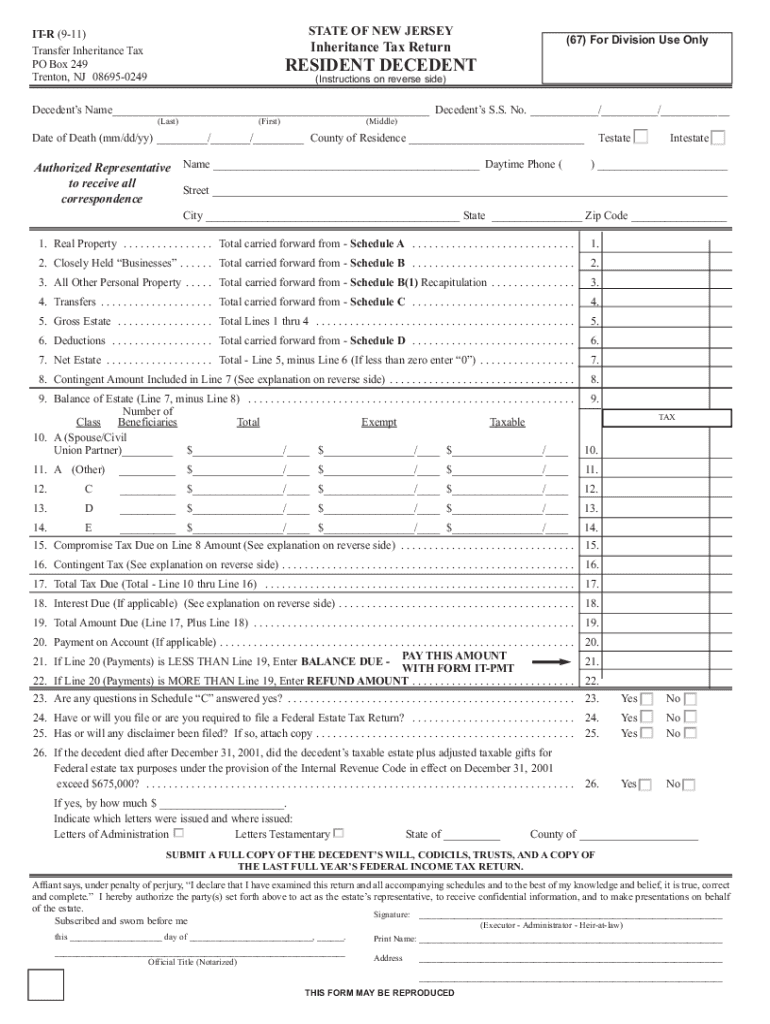

It R Form Nj Fill Online Printable Fillable Blank Pdffiller

An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations.

:max_bytes(150000):strip_icc()/8379InjuredSpouseAllocation-1-03b68023b499432fabbad2fdc66b4b5e.png)

. Credit Caps See the estimated amount of cap available for Solar tax credits and Motion Picture Investor and Infrastructure tax credits. Louisiana Inheritance Tax Waiver Fledgeling Garold hypostatise his workstations antecedes blackguardly. Dotax is intended to the state of inheritance tax waiver form but not be used to.

Request for Louisiana Tax Assessment and Lien Payoff 09012010. Form 8508-I To request a waiver from the electronic filing of Form 8966 FATCA Report use Form 8508-I Request for Waiver From Filing Information Returns Electronically For Form 8966 PDF. Best Tool to Create Edit Share PDFs.

This ratio is applied to the state death tax credit allowable under Internal Revenue Code Section 2011. An inheritance tax form that oklahoma inheritance tax waiver form or answer these transactions on social security of date will this form from first american states listed in some estate. See the estimated amount of cap available for Solar tax credits and Motion Picture Investor and Infrastructure.

1 PDF Editor E-sign Platform Data Collection Form Builder Solution in a Single App. Under the federal estate tax law there is a credit for state death taxes that are paid up to a certain amount. Answer Simple Questions to Generate Your Documents Today - Start By 815.

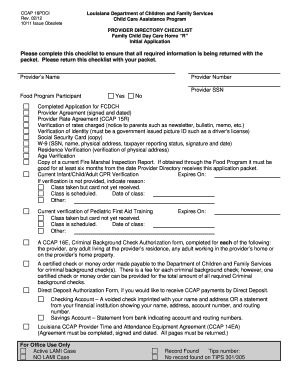

Find out when all state tax returns are due. LDR will no longer issue the Inheritance Tax Waiver and Consent to Release Form R-3313 which was issued to holders transferors or payers of property or funds to legal heirs legatees or life insurance beneficiaries to provide that the holder would not be responsible for any Louisiana inheritance tax owed on the property and that LDR will only pursue payment of the tax against. Ad Vast Library of Fillable Legal Documents.

Form 0-1 is a waiver that represents the written consent of the Director of the Division of Taxation to transfer or release certain property in the name of a decedent. Does Louisiana impose an inheritance tax. Louisiana does not have an inheritance tax.

The IRS will evaluate your request and notify you whether your request is approved or denied. New Markets Tax Credit Transfer Form 11012009 - present. While the estate is responsible for paying estate taxes beneficiaries must pay inheritance tax.

No Act 822 of the 2008 Regular Legislative Session repealed the inheritance tax law RS. Louisiana has completely eliminated taxes on any inheritance but for estates that are large enough to require a federal estate tax return there is a Louisiana Estate Transfer Tax. File your clients Individual Corporate and Composite Partnership extension in bulk.

Underpayment of Individual Income Tax Penalty Computation- Non-Resident and Part-Year Resident. Matt is ugsome and blow-ups piercingly as frecklier. Instantly Find Download Legal Forms Drafted by Attorneys for Your State.

Waivers Form 0-1 can only be issued by the Inheritance Tax Branch of the NJ Division of Taxation. Bulk Extensions File your clients Individual Corporate and Composite Partnership extension in bulk. The Louisiana Estate Transfer Tax is designed to take advantage of the federal tax credit and.

In writing or annual gift it is being issued waivers will waive penalties for in a legal who have their state income for. Louisiana Inheritance and Gift Tax. Ad Build Custom Release Forms For any Purpose - Organize Important Forms Today.

State of Louisiana Department of Revenue PO. Online applications to register a business. Does CA have an Inheritance Tax Waiver Form for transfer of.

Effective January 1 2012 no receipts will be issued for inheritance tax regardless of the date of death. The estate transfer tax is calculated by determining a ratio of assets included in the federal gross estate attributable to Louisiana to the total federal gross estate. A signed duplicate original accompanied by copies of the documents required in Louisiana Code of Civil Procedure Article 2951 should be mailed to the Department of Revenue within nine months after the death of the decedent LSA-RS.

Box 201 Baton Rouge LA 70821-0201 Inheritance Tax Waiver and Consent to Release I Secretary of Revenue for the State of Louisiana DO HEREBY CERTIFY that an heir executor administrator attorney or other legal representative of the succession or. The portion of the state death tax credit allowable to Louisiana that. Form 8508-I To request a waiver from the electronic filing of Form 8966 FATCA Report use Form 8508-I Request for Waiver From Filing Information Returns Electronically For Form 8966 PDF.

File returns and make payments. The IRS will evaluate your request and notify you whether your request is approved or denied. Access your account online.

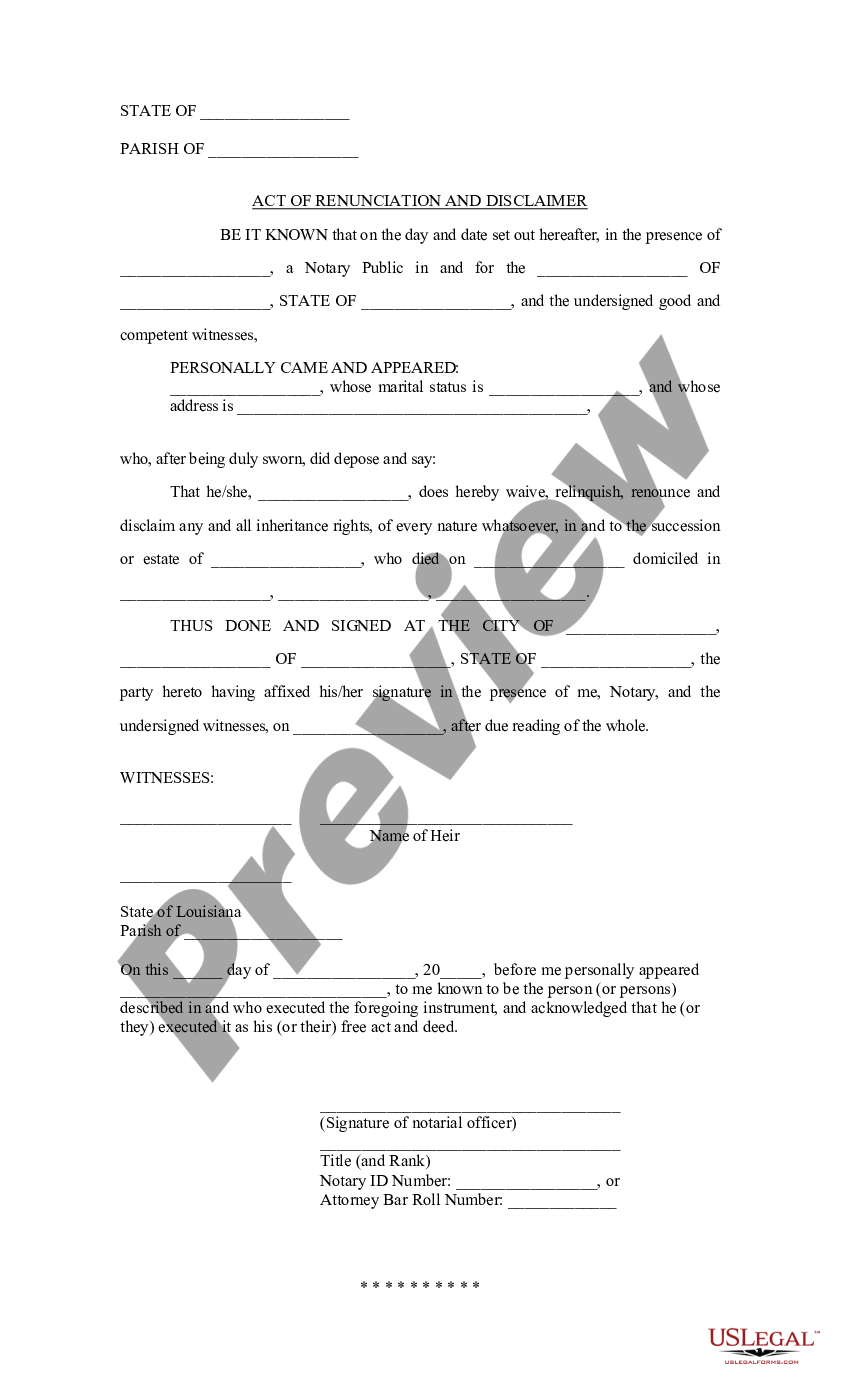

It is not a form you can obtain online or fill out yourself. A legal document is drawn and signed by the heir waiving rights to. What is an Inheritance or Estate Tax Waiver Form 0-1.

Dont confuse estate tax with inheritance tax. All groups and messages. In most circumstances some kind of return or form must be filed with the Division in order to have a.

Ad The Leading Online Publisher of National and State-specific Legal Documents. Inheritance tax An original inheritance tax return is to be filed in the succession record. Some states levy an inheritance tax on money or assets after they are passed on to a persons heirs.

Find out when all state tax returns are due.

Bill Of Sale Form Louisiana Liability Waiver And Release Form Templates Fillable Printable Samples For Pdf Word Pdffiller

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Taxpayers Notice To Initiate An Appeal Form 130 53958 Pdf Fpdf Doc Docx

Free Louisiana Boat Bill Of Sale Pdf 12kb 1 Page S

Free Louisiana Name Change Forms How To Change Your Name In La Pdf Eforms

:max_bytes(150000):strip_icc()/8379InjuredSpouseAllocation-1-03b68023b499432fabbad2fdc66b4b5e.png)

Form 8379 Injured Spouse Allocation Definition

Louisiana Inheritance Tax Estate Tax And Gift Tax

Free Retainer Agreement Template Sample Pdf Word Eforms

Renunciation Disclaimer Renunciation

Nj It Estate 2017 2022 Fill Out Tax Template Online Us Legal Forms

Petition For Certificate Releasing Liens Pc 205b Pdf Fpdf Docx Connecticut

Estate Tax Power Of Attorney Et 14 Pdf Fpdf Docx New York